After the announcement of the results of the 2024 US presidential election, Bitcoin fever returned and less than a month later, the value of this cryptocurrency increased by about 40%, setting an all-time high .

Can Bitcoin break the $100,000 mark?

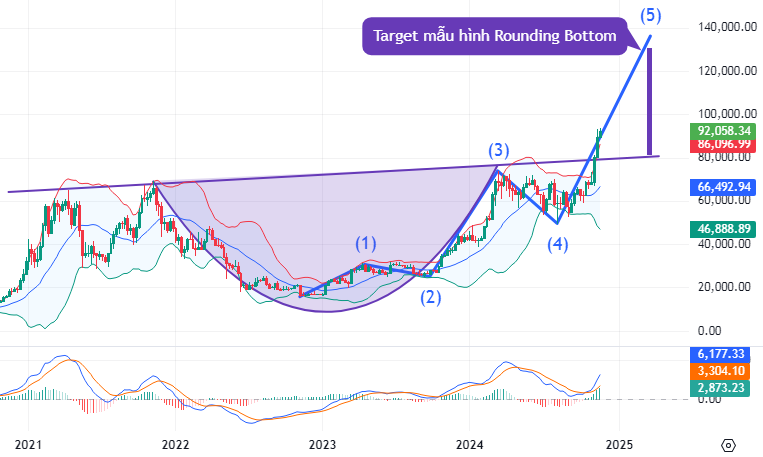

On the weekly chart, according to Elliott wave theory, after experiencing a medium-term correction, it was officially confirmed and entered impulse wave No. 5 after the price surpassed the peak of impulse wave No. 3 in November 2024. .

PresentBTC:continue to closely monitor the upper layer of Bollinger Bands in the context that the MACD indicator is continuously widening the distance with the signal line after giving a previous buy signal, further reinforcing the current uptrend of Bollinger Bands. Bands of this cryptocurrency.

Besides,BTC:A Round Bottom pattern has formed, suggesting a long-term bullish outlook, and the potential price target for this pattern would be 120,000-125,000.

Schedule:BTC:2021 – 2024. Source: TradingView

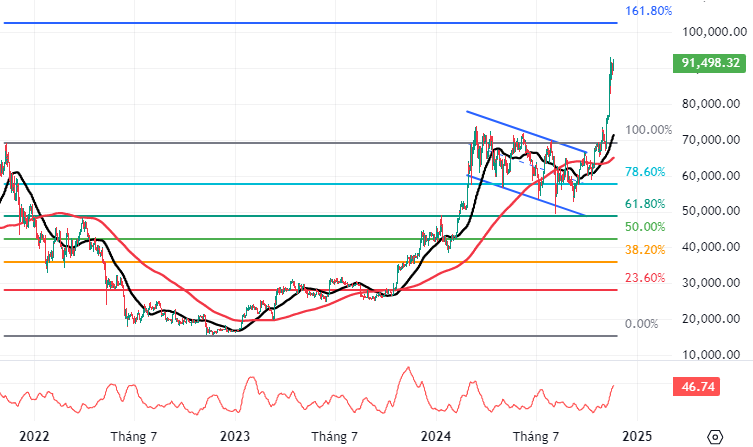

Going back to the daily frame of the chart,BTC:The Golden Cross appeared in the middle of the roadSMA50date andSMA 200 days in the context of the ADX indicator, after breaking out of the gray zone (20 Besides,BTC:surpassed the upper edge of the Bearish Price Channel and also exceeded the 100% Fibonacci Retracement threshold (equivalent to the 66,500-71,500 area).USD)BTC:The target will be the 100,000-105,000 areaUSDcorresponding to the Fibonacci Retracement threshold of 161.8%. From the above signals, the writer believes that investors can take advantage of short-term fluctuations to make exploratory purchases to achieve long-term goals in the future. Schedule:BTC:2022 – 2024. Source: TradingView