If financial conditions are truly as tight as Fed officials claim, it seems the market hasn’t gotten the message yet.

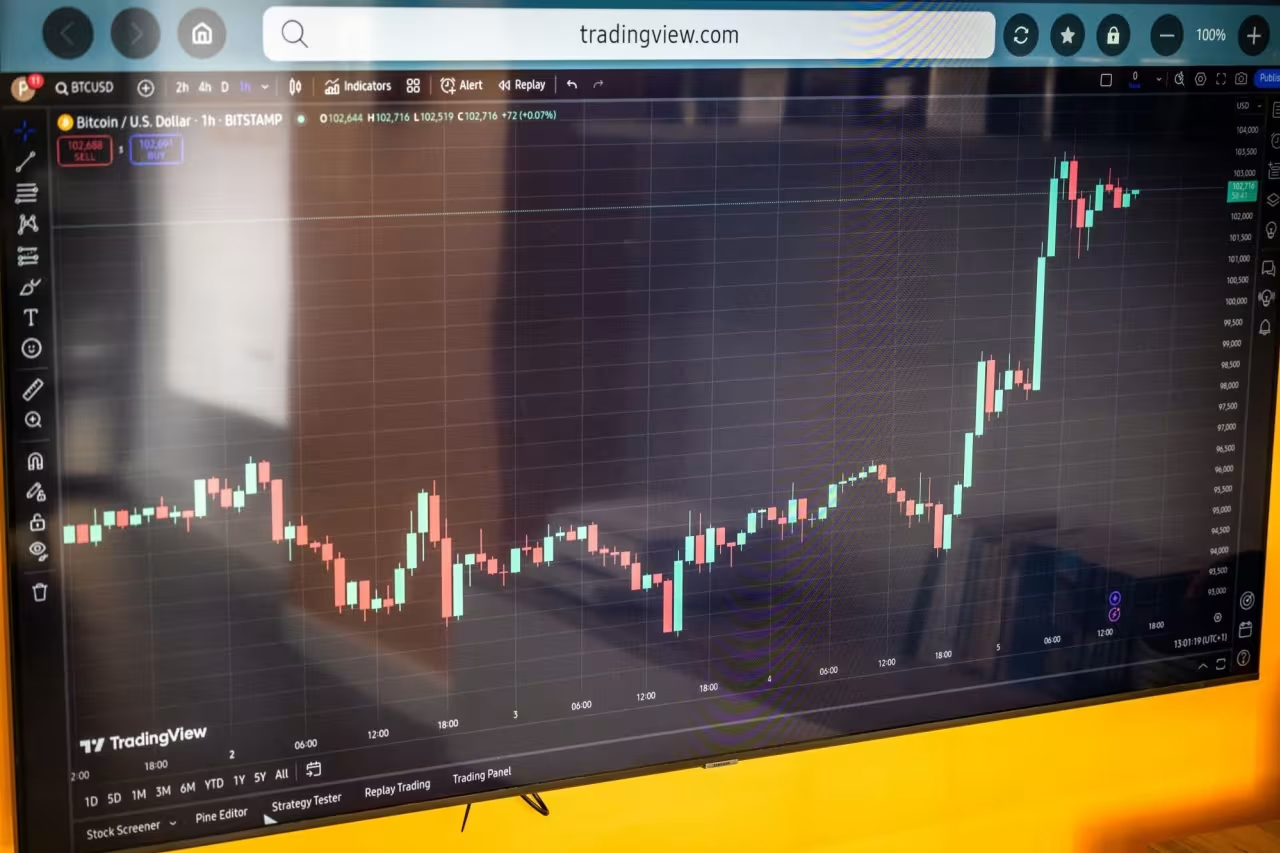

Bitcoin surpassed the 100,000 mark this week, while the Dow Jones index surpassed the 45,000 mark for the first time.

Financial media believes that Bitcoin’s rise is due to expectations that the Trump administration will be more friendly to virtual currencies.

One of the biggest gainers is MicroStrategy, up 464% this year.billion dollars.billion dollars.

MicroStrategy has announced plans to spend 40billion dollarsbought more bitcoin in October, fueling a wave of buying of both the company’s stock and bitcoin.

Like the meme stock rally of early 2021, it is only as good as the “upbeat music continues.”

However, be careful because Bitcoin prices are inherently volatile.

Looking broadly at the market, there are more and more signs of excitement.

However, the ratio’s P/E level of 36 is reminiscent of the dot-com bubble.

The last time the yield differential between risky bonds and government bonds was this low was in 2007 and before that in 1997, when the market was also flooded with money.consumer prices (CPI)core excluding food and energy was 3.3% compared to June.

Even the Fed’s preferred measure of inflation, the personal consumption expenditures price index (), has stopped trending downward.

Although the Fed is signaling another 25 basis points of rate cuts this month, it is rare for a central bank to cut interest rates amid persistent inflation, strong growth and high asset prices. in history.